Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Performance Appraisal of Pradhan Mantri Mudra Yojana (PMMY)

Authors: Dr. Pradeep Kumar

DOI Link: https://doi.org/10.22214/ijraset.2025.66945

Certificate: View Certificate

Abstract

This study focuses on the Pradhan Mantri Mudra scheme\'s performance review. The program was introduced on April 8, 2015, and its primary objectives are to increase the number of Micro and Small Businesses and the general public\'s level of life. The bank offers three different loan categories under the PMMY: Shishu, Kishor, and Tarun. The government created MUDRA (Micro Units Development & Refinance Agency Limited) to implement the Scheme. This organization is in charge of micro unit development and refinance and functions as a microfinance sector overall. All banks wishing to refinance small business loans obtained under the PMMY program can do so under the MUDRA scheme. The overview of Mudra Yojana, including its programs and PMMY\'s overall performance, is the primary subject of this study. The secondary source of data used in this study has been gathered from a variety of publications, papers, and MUDRA websites.

Introduction

I. INTRODUCTION

The Hon’ble Prime Minister Shri Narendra Modi introduced the MUDRA Yojana (PMMY) on April 8, 2015, with the goal of lending up to Rs. 10 lakh to small and micro businesses that are neither corporations nor farms. Three products—"Shishu," "Kishore," and "Tarun"—have been developed by MUDRA to represent the financial requirements and growth/development stage of the recipient micro unit or entrepreneur. They also serve as a benchmark for the subsequent graduation/growth phase. Commercial Banks, RRBs, MFIs, NBFCs, Cooperative Banks, and Small Finance Banks all offer these loans. The primary goal of this program is to encourage and inspire businesses to open more and more locations around the nation. Mudra loans (Micro Units Development & Refinance Agency Limited) are the primary name for these loans. The Indian government has established several mudra units around the nation to help make this initiative a success. These units refinance banks, who subsequently give these loans to small loan applicants. Their primary goal is to assist these loan applicants financially.

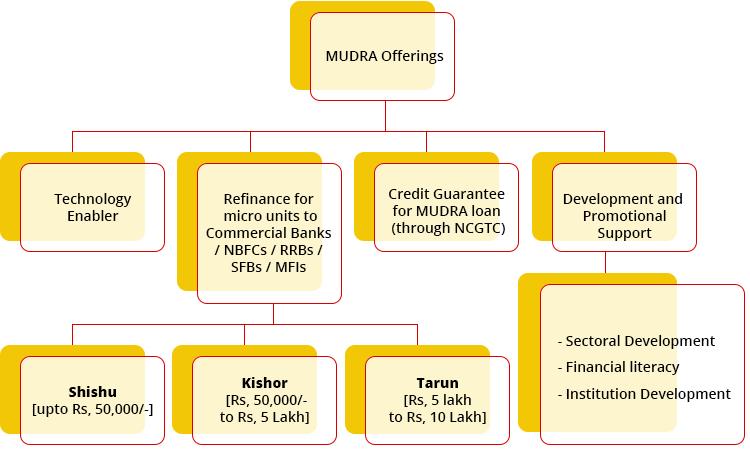

A. Product/Offerings of MUDRA

Banks, MFIs, and NBFCs can use MUDRA's refinancing assistance to lend up to Rs. 10 lakh to micro units that require loans. MUDRA offers microbusinesses refinancing support under the Pradhan Mantri MUDRA Yojana Scheme. The sector's development is supported by the various products and offerings. The collection of MUDRA's offerings is displayed below. A wide range of benefit categories are the focus of the products.

MUDRA launched the "Shishu," "Kishore," and "Tarun" products and schemes under the Pradhan Mantri Mudra Yojana (PMMY) umbrella to reveal the beneficiary micro unit's or entrepreneur's stage of growth and funding needs. These programs also serve as a benchmark for the upcoming graduation/growth phase. This program places a greater emphasis on Shishu Category Units, followed by Kishore and Tarun categories, in order to encourage entrepreneurship among the younger generation. The Mudra plan has been intended to meet the needs of various business sectors and activities, as well as company and entrepreneur segments. Under the MUDRA initiative, funding help is provided in two ways:

- Micro Credit Scheme (MCS), which provides loans through MFIs up to Rs. 1 lakh for a range of small company and microenterprise operations.

- A refinance program for small finance banks, commercial banks, regional rural banks (RRBs), and non-banking financial companies (NBFCs) to fund microbusiness ventures. Term loans and working capital loans up to Rs. 10 lakh per unit are eligible for the refinancing.

B. Purpose of MUDRA Loan

Mudra loans serve a number of functions that lead to the development of jobs and revenue. The following are the primary reasons the loans are given out:

- Loans for businesses in the service sector, including traders, vendors, and shopkeepers

- Working capital loans made possible with MUDRA cards

- Finance for Micro Unit Equipment

- Loans for commercial usage solely for transport vehicles

- Loans for agri-allied non-farm revenue-generating ventures, such as poultry farming, beekeeping, and pisciculture

- Loans for tractors, tillers, and two-wheelers used only for business.

II. REVIEW OF LITERATURE

Dwivedi and Agarwal (2017) The Pradhan Mantri Mudra Yojana (PMMY) scheme's performance was examined in the study according to state, caste, and category. The report explains PMMY's features and SWOT analysis. While Assam and Tripura have the greatest growth rates, Union Territories like the A&N Islands and Lakshadweep have negative and unsatisfactory state-by-state growth rates. According to the study's findings, the PMMY plan is a praiseworthy government initiative that has greatly benefited the poor and weaker segments.

Soni (2016) Understanding the MUDRA (Development of Micro Units and Refinancing Agency) is the aim of this study article. This paper's primary goal is to comprehend the Mudra plan, its need, and the legal framework needed to take advantage of it. To investigate the ideas suggested by the government for this project's effective completion. This study is descriptive in nature and uses secondary data, which was sourced from government websites, media, and institute publications. In the end, the author came to the conclusion that the currency would boost small businesses' confidence and inspire young, intelligent, or talented individuals to expand their operations. Additionally, MUDRA Yojana plays a significant role in empowering women.

Ramesh (2016) The performance evaluation of Mudra Bank Schemes was the main subject of this investigation. This paper's goal is to investigate the performance of Mudra Bank schemes. MUDRA data for 2015–16 was gathered from secondary sources, including websites, journals, and newspapers, for this descriptive study. According to studies, the Shishu plan performed very well and provided greater benefits to the SC, ST, and OBC categories than other schemes.

Girnara (2015) This paper illustrates the MUDRA Yojana's effects on the Indian economy and its function in encouraging entrepreneurship. This paper's primary goals are to describe the Mudra bank scheme, the interest rate on the loan, and the beneficial effects and role efficacy of the Mudra system on the Indian economy. The interest rate of the Mudra Bank loan is lower than that of other business loans, according to the comparison of the two types of loans made in this article. Mudra loans have relatively low costs and document requirements. The author claims that the Mudra initiative has boosted Indian entrepreneurship and given the economy a good trajectory.

A. Objectives of the Study

- To evaluate the PMMY (Pradhan Mantri Mudra Yojana)

- To assess how well the various MUDRA Scheme categories perform

- To comprehend the significance of PMMY's product offerings

III. RESEARCH METHODOLOGY

The nature of the current study project is descriptive. The overview of Mudra Yojana, including its schemes and PMMY's performance, was the main subject of this study. It also assessed how financial institutions in various Indian states disbursed loans. The majority of the data included in this research study comes from secondary sources, which include government websites, articles, research papers, the Mudra website, books, newspapers, and conversations with bank representatives. Tools from descriptive statistics were used to analyze the data.

IV. REVIEW OF PERFORMANCE OF PRADHAN MANTRI MUDRA YOJANA

After nine years of operation, the Prime Minister's flagship program, Pradhan Mantri Mudra Yojana (PMMY), which aims to fund underfunded microbusinesses and small enterprises, has extended a total of 22.89 lakh crore under the program to 41.16 crore loan accounts, primarily benefiting borrowers from the most vulnerable segments of society. Collectively, the lending institutions—which comprise all public and private sector banks, regional rural banks, small finance banks, micro-finance institutions (MFIs), and non-banking financial companies (NBFCs)—have consistently surpassed the yearly goals established by the Indian government under PMMY. As a support organization, Micro Units Development & Refinancing Agency Ltd. (MUDRA) has fulfilled two roles over the course of these nine years: it has provided refinance assistance to a number of lending institutions and kept a close eye on the PMMY implementation process through a dedicated portal that collects various aggregated data related to the PMMY scheme in accordance with the needs of the Indian government.

Table 1

Institution wise Performance

(? in crore)

|

Category |

Disbursed |

Disbursed |

Disbursed |

Disbursed |

Disbursed |

|

Public Sector Banks (incl. Regional Rural Banks) |

1,17,281.85 |

1,17,729 |

1,29,915 |

1,24,425.00 |

1,71,118.78 |

|

Private Sector Banks (incl. Foreign Banks) |

64,037.25 |

91,780 |

93,613.20 |

1,17,679.30 |

1,41,116.00 |

|

Small Finance Banks |

29,794.37 |

29,501 |

19,646.68 |

29,207.40 |

38,297.00 |

|

Micro Finance Institutions |

63,470.97 |

57,967 |

46,601.40 |

49,101.18 |

66,830.62 |

|

Non-Banking Finance Companies |

47,136.75 |

40,518 |

31,983.17 |

18,697.14 |

33,061.27 |

|

State Co-operative Banks |

0 |

0 |

0 |

0.36 |

0 |

|

Total |

3,21,722.79 |

3,37,495 |

3,21,759 |

3,39,110.40 |

4,50,423.62 |

The Table 1 provides data on the disbursed amount by various categories of financial institutions in India for the financial years 2018-19 to 2022-23. The total disbursed amount has shown a steady increase over the years, with a significant jump from ?3,21,759 crore in 2020-21 to ?4,50,423.62 crore in 2022-23. Public sector banks, including regional rural banks, have consistently disbursed the largest amount among all categories, with a significant increase from ?1,17,281.85 crore in 2018-19 to ?1,71,118.78 crore in 2022-23. The market share of public sector banks has remained relatively stable, ranging from 36.4% to 38.0%. Private sector banks, including foreign banks, have also shown a significant increase in disbursed amount, from ?64,037.25 crore in 2018-19 to ?1,41,116 crore in 2022-23. The market share of private sector banks has increased from 19.9% in FY 2018-2019 to 31.3% in FY 2022-23. Small finance banks have shown a fluctuating trend, with a decrease from ?29,794.37 crore in 2018-19 to ?19,646.68 crore in 2020-21, followed by an increase to ?38,297 crore in 2022-23. The market share of small finance banks has remained relatively stable, ranging from 9.3% to 8.5%. Micro finance institutions have shown a fluctuating trend, with a decrease from ?63,470.97 crore in 2018-19 to ?46,601.40 crore in 2020-21, followed by an increase to ?66,830.62 crore in 2022-23. The market share of micro finance institutions has declined from 19.8% in FY 2018-2019 to 14.8% in FY 2022-23.

The disbursement amount by NBFCs has decreased from ?47,136.75 crore in FY 2018-2019 to ?33,061.27 crore in FY 2022-23. The market share of NBFCs in the total disbursement amount has declined from 14.6% in FY 2018-2019 to 7.3% in FY 2022-23. The data suggests that public sector banks and private sector banks have played a significant role in disbursing credit in India under PMMY scheme, with a steady increase in disbursed amount over the years. Small finance banks and micro finance institutions have shown fluctuating trends, but have still contributed significantly to credit disbursal.

Table 2

Performance of Top 10 States

(? in crore)

|

Sr. |

Name of state |

Disbursement Amt (2018-2019) |

Disbursement Amt (2019-2020) |

Disbursement Amt (2020-2021) |

Disbursement Amt (2021-2022) |

Disbursement Amt (2022-2023) |

|

1 |

Uttar Pradesh |

26,191 |

30,949 |

29,231.35 |

32,850.80 |

47,427.26 |

|

2 |

Bihar |

24,406 |

27,442 |

25,589.31 |

30,725.07 |

45,448.59 |

|

3 |

Tamil Nadu |

34,260 |

35,017 |

28,967.97 |

32,262.94 |

43,730.39 |

|

4 |

Karnataka |

29,995 |

30,188 |

30,199.18 |

28,374.92 |

40,746.09 |

|

5 |

West Bengal |

26,462 |

26,790 |

29,335.98 |

33,949.81 |

38,353.85 |

|

6 |

Maharashtra |

26,439 |

27,903 |

25,208.63 |

25,416.48 |

36,104.52 |

|

7 |

Madhya Pradesh |

17,408 |

19,060 |

18,474.24 |

18,218.44 |

24,632.59 |

|

8 |

Rajasthan |

17,506 |

19,662 |

18,571.38 |

18,728.94 |

24,492.62 |

|

9 |

Odisha |

15,770 |

15,419 |

15,328.63 |

16,557.27 |

21,505.13 |

|

10 |

Gujarat |

13,217 |

13,746 |

11,579.26 |

11,990.04 |

17,507.49 |

|

|

Total |

2,31,654 |

2,46,176 |

2,32,485.93 |

2,49,074.71 |

3,39,948.53 |

The Table 2 provides valuable insights into the trend of funding for development projects in various states in India. The consistent increase in disbursement amount indicates a positive trend in funding for development projects. The total disbursement amount has consistently increased from ?2,31,654 crore in 2018-2019 to ?3,39,948.53 crore in 2022-2023. Most states have shown significant growth in disbursement amount over the years, with Uttar Pradesh, Bihar, and Tamil Nadu being the top three states. Uttar Pradesh has consistently been one of the top states in terms of disbursement amount, with a growth rate of 80.9% from 2018-2019 to 2022-2023. Bihar has shown the highest growth rate of 86.1% from 2018-2019 to 2022-2023, indicating significant development in the state. Tamil Nadu has shown a moderate growth rate of 27.5% from 2018-2019 to 2022-2023, indicating a stable development trajectory. States like UP, Bihar, and Madhya Pradesh have shown significant growth in disbursement amount, indicating development in the region. States like Tamil Nadu, Karnataka, and Gujarat have shown moderate growth, indicating a stable development trajectory. The consistent increase in disbursement amount indicates a positive trend in funding for development projects. The growth in disbursement amount in various states indicates a focus on regional development and reducing regional disparities. The overall increase in disbursement amount indicates a positive trend in economic growth and development.

Table 3

Category wise Analysis of PMMY Scheme

(? in crore)

|

|

Shishu |

Kishor |

Tarun |

Total |

|

|

2018-19

|

No. of loan |

5,15,07,438 |

66,06,009 |

17,56,871 |

5,98,70,318 |

|

Disbursement |

1,42,345 |

1,04,387 |

74,991 |

3,21,723 |

|

|

2019-20 |

No. of loan |

5,44,90,617 |

64,71,873 |

12,85,116 |

6,22,47,606 |

|

Disbursement |

1,63,528 |

95,578 |

78,358 |

3,37,495 |

|

|

2020-21 |

No. of loan |

4,01,80,115 |

94,86,160 |

10,68,771 |

5,07,35,046 |

|

Disbursement |

1,09,953 |

1,32,516 |

79,290 |

3,21,759 |

|

|

2021-22 |

No. of loan |

4,17,21,154 |

1,10,88,206 |

9,86,166 |

5,37,95,526 |

|

Disbursement |

1,23,969.05 |

1,33,389.24 |

74,043.91 |

3,31,402.20 |

|

|

2022-23 |

No. of loan |

4,30,77,851 |

1,79,15,912 |

13,16,835 |

6,23,10,598 |

|

Disbursement |

1,41,609.85 |

2,00,936.63 |

1,07,877.18 |

4,50,423.66 |

|

The Table 3 provides data on the number of loan accounts and disbursed amount of various categories of offerings under PMMY scheme. The total number of loan accounts has increased from 5,98,70,318 in 2018-19 to 6,23,10,598 in 2022-23, indicating a growing demand for credit in the economy. The total disbursement amount has increased from ?3,21,723 crore in 2018-19 to ?4,50,423.66 crore in 2022-23, indicating a significant increase in the amount of credit being disbursed. The number of loan accounts in the Shishu category has decreased from 5,15,07,438 in 2018-19 to 4,30,77,851 in 2022-23, indicating a decline in focus towards this category. The disbursement amount in the Shishu category has remained relatively stable, with a slight decrease from ?1,42,345 crore in 2018-19 to ?1,41,609.85 crore in 2022-23. The number of loan accounts in the Kishor category has increased significantly from 66,06,009 in 2018-19 to 1,79,15,912 in 2022-23, indicating a shift in focus towards this category. The disbursement amount in the Kishor category has also increased significantly from ?1,04,387 crore in 2018-19 to ?2,00,936.63 crore in 2022-23. The number of loan accounts in the Tarun category has decreased from 17,56,871 in 2018-19 to 13,16,835 in 2022-23, indicating a decline in focus towards this category. The disbursement amount in the Tarun category has increased from ?74,991 crore in 2018-19 to ?1,07,877.18 crore in 2022-23. The Kishor category has shown significant growth in both loan accounts and disbursement amount, indicating a shift in focus towards this category. The Shishu and Tarun categories have shown a decline in loan accounts, indicating a decrease in focus towards these categories. The total number of loan accounts and disbursement amount has shown an increasing trend, indicating a growing demand for credit in the economy. The significant growth in the Kishor category indicates the need for targeted interventions to support this segment. The decline in loan accounts in the Shishu and Tarun categories indicates the need to revitalize these categories and increase focus towards them. The increasing trend in total loan accounts and disbursement amount indicates the need to ensure sustainable credit growth to support economic development.

Conclusion

The Micro Units Development & Refinance Agency Limited (MUDRA) and Pradhan Mantri Mudra Yojana (PMMY) play a crucial role in ensuring that the bottom of the pyramid is not excluded and that they equally contribute to the process of wealth development and nation building. In the nine years after PMMY\'s inception, MUDRA loans have become the go-to choice for all participants in the unorganized and underfunded sector to start their own personal journeys of growth and livelihood, therefore contributing to the group\'s goal of development. Over the past nine years, MUDRA loans have gradually changed our nation\'s semi-urban, rural, and hinterland areas. MUDRA has become a brand that is associated with empowerment and hope as a result of creating and fortifying the official credit channels for fostering the green shoots at the grassroots level.

References

[1] Agarwal M, Dwivedi R. Pradhan Mantri Mudra Yojna: A Critical Review. Parikalpana - KIIT Journal of Management, 2017, 97-106. [2] Girnara M. Mudra Yojna and its role in promoting entrepreneurship and impact on Indian Economy, 2015, (p. PAPER ID: PT0070). [3] Godha A, Nama D. Pradhan Mantri Mudra Yojana: A New Financial Inclusion Initiative. International Journal of Engineering Technology, Management, and Applied Sciences. 2017;5(3):200-204. https://www.researchgate.net/publication/343007887. [4] Jain R. Micro Units Development and Refinance Agency (Mudra) Yojana: The Most Innovative Way for Upliftment of Micro Industries. International Journal of Core Engineering & Management, 2015, 2(8). [5] Official website of MUDRA scheme. (http://www.mudra.org.in) [6] Ramesh, P. Performance Evaluation of Mudra Bank Schemes - A Study. Anveshana’s International Journal of Research in Regional Studies, Law, Social Sciences, Journalism and Management Practices. 2016, 116-120. [7] Roy, Anup Kumar. “Mudra Yojana- A Strategic tool for Small Business Financing”, International Journal of Advance Research in Computer Science and Management Studies. 2016;4(1):68-72. [8] Shahid M, Irshad M. A Descriptive Study of Pradhan Manthri Mudra Yojana (PMMY). International Journal of Latest Trends in Engineering and Technology, 2016, 121-125. [9] Soni A. MUDRA: Micro Units Development and Refinance Agency. EPRA International Journal of Economic and Business Review, 2016, 33-36.

Copyright

Copyright © 2025 Dr. Pradeep Kumar. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET66945

Publish Date : 2025-02-13

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online